Open RAN – Where Are We?

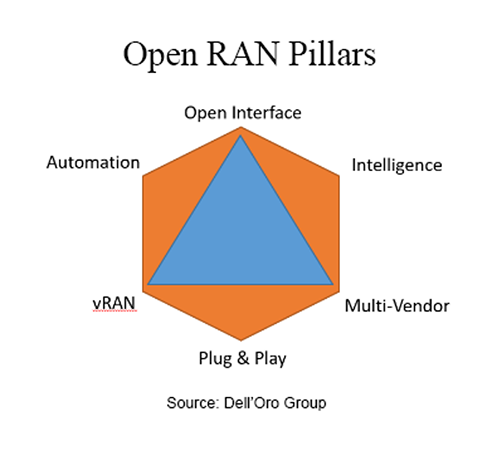

Not all Open RAN is the same. Implementations vary widely in this initial phase, with some operators focusing first on the interface before tackling vRAN and multi-vendor deployments while others prioritize virtualization before addressing multi-vendor RAN. As a result, single-vendor Open RAN is now driving a material portion of the overall Open RAN market.

Figure 2: Open RAN Pillars

Figure 2: Open RAN Pillars

In other words, even if the market is accelerating at a faster pace than initially expected, the rise of Open RAN has so far had a limited impact on the broader RAN (proprietary and Open RAN) supplier dynamics. Per Dell’Oro’s 4Q22 RAN report, the collective RAN share of the top five RAN vendors (Huawei, Ericsson, Nokia, ZTE, and Samsung) declined by less than one percentage point between 2021 and 2022, partly because the leading Open RAN supplier (Samsung) is also an established RAN supplier.

At the same time, market concentration as measured by the Herfindahl-Hirschman Index (HHI) is improving, with the global RAN HHI down around six percent in 2022 relative to 2020 levels. Although a confluence of market-related and geopolitical factors can help to explain the downward HHI trend, it is challenging to compute the exact contribution from the various events in isolation. Still, our assessment is that Open RAN is contributing to some of the HHI RAN decline, even if the overall impact has been more muted than initially expected. It is early days to estimate marginal efficiency improvements with Open RAN. Preliminary findings suggest next-generation architectural savings will likely be mostly driven by everything around the O-RAN equipment, partly because the radio and baseband equipment together account for 10