3 Tech Trends to Watch in 2021

For example, in October 2015, the European Parliament adopted PSD2 (the revised Directive on Payment Services). By early 2020, major banks in the EU adopted open APIs. There have, however, been many cases of late deployments of APIs and problems with API availability.

Open banking is a major disruptive factor for banks, as it opens up account data to AISPs (Account Information Service Providers) and PISPs (Payment Initiation Service Providers), which can attempt to carve out a role in the banking area.

AISPs: These new vendors can access transaction data and balance information, as well as related information. This has led to the rise of vendors such as Emma, Yolt and Connected Money, which aggregate information from multiple sources to add value to the user.

PISPs: These new vendors can leverage open banking API connections to initiate payments directly from the bank accounts in question. This enables these players to bypass traditional payment methods, such as cards. Vendors such as American Express and PayPal have already launched solutions that take advantage of this.

Generally, the implementation of PSD2 reduces the entry barrier for new digital players and opens banks to competition, enabled by their own APIs. This allows these players to compete with existing services in fields currently offered by the banks. In the case of AISPs, it is possible that third-party applications could displace the role of the apps from incumbent players, which would dilute the bank’s relationship with their users.

Open Banking Opportunities and Challenges

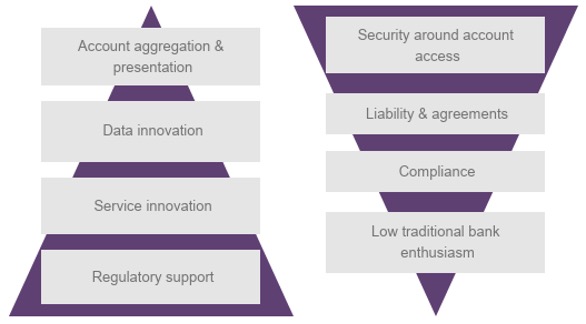

As with any fundamental change to markets in the banking area, there are numerous opportunities and challenges to consider with open banking.

Figure 2: Open Banking Opportunities and Challenges

[click to enlarge]

Banks and other parties seeking to become involved in the open banking ecosystem must weigh these opportunities and challenges carefully. Open banking requires a more collaborative approach than traditional banking models, which will require significant effort to make successful.

The total number of open banking users will double between 2019 and 2021, reaching 40 million in 2021 from 18 million in 2019. The ongoing coronavirus pandemic is increasing the need for consumers to aggregate accounts and gain insight on their financial health, boosting momentum in open banking adoption. Open banking - along with instant payments and A2P messaging - are certainly technology trends you will want to watch in 2021 and beyond.