Making Cents with Mobile Money

Ericsson has been very active in promoting its mobile money offering. The company wants to bridge the gap, making it simple for banks, operators, merchants and governments collaborate to create an environment where m-commerce thrives.

“Combining bank licenses, expertise and services with operator reach, relationships, agent networks and customer insights is the key to unlocking the global mobile money market to everybody’s benefit,” argues Ericsson. “We can facilitate this collaboration by harmonizing systems and technologies, orchestrating joint value propositions and expanding the ecosystem to include relevant third parties.”

Other competitive offerings on the market are available from vendors like Amdocs, the company that launched the world’s first digital wallet on 2004, and Gemalto, whose mobile money and mobile wallet technology is widely used in Africa.

Telenor’s solution

In December of 2014, Telenor Hungary introduced a multi-pronged mobile money solution that is an example of what can be achieved by an MNO. The offering is a combination of a mobile wallet solution (MyWallet) and a mobile payment solution (MyCard).

“Telenor Financial Services is a new approach to personal finance," said Zoltán Takács, Chief Digital Services Officer. "It is designed around our customers with smartphone and Hipernet in their hands, and it combines credit card, a mobile application with extremely appealing collection of discounts and benefits.”

Lessons from the developing world

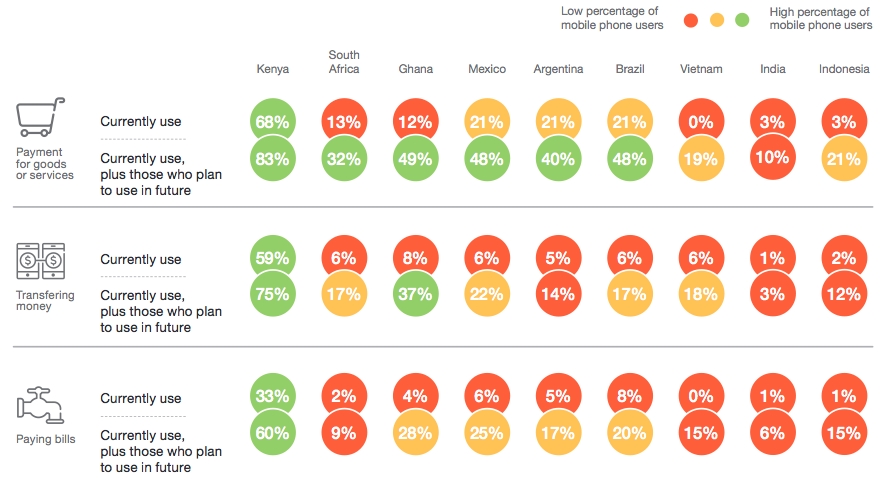

Interestingly, many countries in the developing world have leapfrogged the rest of the world in terms of mobile money. As you can see in figure 2, the use of mobile money is popular for a wide variety of solutions.

Vodafone’s very popular M-Pesa service began in Africa and has since migrated to India and Europe. It is essentially a bank-less money transferring service that functions via SMS messaging. In this way, the global operator group has outmaneuvered traditional financial services institutions. The service has become a prime revenue generator for brands like Safaricom, which reported roughly $25 million in revenue from M-Pesa in 2014.

Fig. 2: Financial Services Used on Mobile Devices. Source: Ericsson ConsumerLab

At the same time, mobile network operators are busy working with the banks to bring mobile financial services to the people. Orange recently partnered with the Bank of Africa to enable Orange Money customers to transfer money directly from their Orange Money account to their BOA account and vice versa, simply with a mobile device. The Orange Money service currently has more than 11 million customers in 14 countries in Africa and the Middle East, and subscription to Orange Money is free of charge.