Learning the Mobile Magic of Disruptive Operators

Leap Wireless, better known as Cricket, has made a lot of headway in the past five years, and in 2012 became the first wireless provider to offer the iPhone 4S without a contract. Like E-Plus in Germany, Cricket recently began to explore a multibrand strategy, and despite servicing a price-sensitive customer base, it has consistently improved its average revenue per user (ARPU). The hybrid network operator also owns one of the most popular digital music services in the US, Muve Music.

Lastly, if the merger of T-Mobile and MetroPCS is approved, the US market may soon experience disruption akin to that of Denmark, France and Germany. But until that day arrives, let’s take a look at what’s working for these wizards of wireless.

Prepaid is paying off

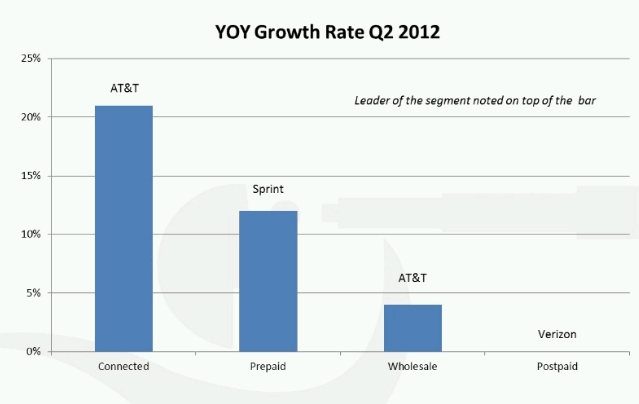

Consumers have voiced a preference for greater freedom and flexibility in their wireless service plans, leading to an expansion of the prepaid market. The year-on-year growth rate for postpaid has flatlined, but prepaid continues to grow at about 12 percent annually, and the only segment growing faster than prepaid is connected devices, which encompasses machine-to-machine (M2M) connectivity (Fig. 1).

Fig. 1: Year-on-year growth rate for wireless

service plans (source: Chetan Sharma

Consulting, August 2012)

Fig. 1: Year-on-year growth rate for wireless

service plans (source: Chetan Sharma

Consulting, August 2012)

When Pipeline examined the success of prepaid wireless service last August, we predicted this trend. Prepaid no longer has an image problem, and its customers now enjoy iPhones, LTE data, direct-pay billing, and numerous value-added digital services, all traits that once defined postpaid service.

T-Mobile USA intends to dominate prepaid by absorbing MetroPCS and offering unlimited 4G service with no strings attached. Outlining his company’s challenger strategy during a webcast last October, CEO John Legere said, “The no-contract market is growing at more than three times the pace of the contract market,” and he predicted that “in terms of revenue we will be the leading provider of no-contract services.”

It’s clear that as CSPs move into 2013 they must have a solid prepaid strategy in place. “Prepaid is critical to revenue and subscriber growth, at a time when wireless providers are striving to boost performance in an increasingly saturated market,” says International Data Corporation (IDC) analyst John Weber.

Wi-Fi is a game changer

“Wi-Fi has become more than an offloading solution,” Torbjörn Wård, CEO of Aptilo Networks, told Pipeline. “Operators are embracing it as simply another radio network; they’re using it for coverage for dense areas or indoors. One driver of this is cellular base-station vendors, which are starting to sell their regular micro and pico base stations with Wi-Fi radio access built in, just like GSM, UMTS and LTE.”

When Free made its striking transition from broadband ISP to mobile service provider in France, it did so by leveraging a massive network of five million Wi-Fi hotspots. By comparison, France Telecom only operates about 30,000 Wi-Fi access points.