Achieving Pole Position in the Connected Car Ecosystem

Sprint, for example, is positioning itself as the leading systems integrator (SI) for the connected car. As previously mentioned, it’s brought in Airbiquity to handle Sprint Velocity’s smartphone and in-car apps, Aeris for M2M expertise and WirelessCar for additional telematics support. “Sprint is a mobile integrator,” says Tom Nelson, the company’s director of marketing, global wholesale and emerging solutions. “We look at the car as just another device, and it should be as intuitive as your smartphone and tablet. We are pulling together the different pieces.”

Not every CSP is cut out to be an SI for the connected car; some may function best as enablers of a subset of services. In figure 3 below, Sprint identifies the following value propositions in the connected-car ecosystem.

Connected-car value propositions (Source: Sprint, 2013)

Capturing new revenue streams

In addition to maintaining a razor-sharp focus on the customer experience, the three best tools in a CSP’s arsenal for capturing new revenue streams in the connected-car ecosystem are:

- An agile, real-time billing system that supports multiple subscription types, single-use payment, premium day passes, in-app billing, ad-supported zero-rated access, and trial models all at the same time, occasionally for the same subscriber. The system must also be able to allocate charges and revenues to a number of beneficiaries (automaker, consumer or third party) for their respective connectivity elements.

- An advanced policy control that enables and effectively manages multiple, simultaneous application streams to the same SIM (subscriber identity module).

- Deep partnerships with auto manufacturers, pure-play M2M and telematics players, software companies that have smartphone integration solutions (e.g., Abalta), and industry working groups such as the Autotech Council, the ng Connect Program, and the Car Connectivity Consortium. In all likelihood the connected-car industry will move from a one-to-one relationship with its CSP partners to an open ecosystem where consumers can select from several service providers at the point of purchase; in fact, the industry is developing an embedded, standardized “single SIM” that can switch between providers. A deep, wide partner ecosystem will diversify CSPs’ options.

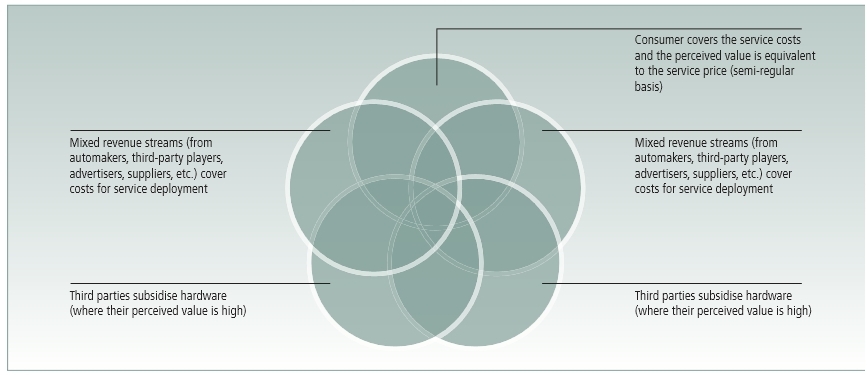

As you can see in figure 4, the revenue clouds for the connected car and its potential participants overlap significantly, further emphasizing both the complexity of the ecosystem and the need for CSPs to have flexible business models.

Potential revenue streams for connected-car services (Source: GSMA, 2012)