Survival Guide: Living Off of Big Data

Big Data for CEM

Most of the growth in data traffic has come from OTT services, and when they cause problems, oftentimes it’s the connectivity service provider, not the app developer, that has to field the support calls. Put into perspective, CSPs are often inadvertently enabling and supporting the very businesses that are cannibalizing their revenue streams.

This state of affairs probably won’t change, so why not go all the way? CSPs could become the CEM enabler for the most popular services on the planet—and charge for them, no less. Right now the only companies with the ability to realize an end-to-end view of traffic, service, network, and device performance are the ones holding the pipes. Unfortunately, the raw services they provide have become commodities.

CSPs should craft deals with OTT players that leverage network and subscriber data, allowing the OTTs to deliver a guaranteed quality of service (QoS). In this manner, the data can be monetized as a premium service offering and delivered through myriad retail channels, including both the OTTs’ and CSPs’ portals and third-party platforms such as Xbox Live.

Furthermore, the OTTs can pay to access the customer bases of large telcos in order to expand their premium offerings into new markets. This strategy is already being implemented by some CSPs: TelefĂłnica recently announced a global partnership with Evernote to provide Evernote Premium for its customers in Latin America, and Deutsche Telekom has joined up with Spotify to offer Spotify Premium to DT customers.

Targeted advertising

One of the hottest intersection points on the Big Data map is dynamic targeted advertising. Real-time analytics provide valuable insight into customer behavior and promotional performance, ultimately informing business decisions. Add in mobility and location-based data and the future of advertising is indeed upon us.

“There’s a $260 billion advertising industry out there just trying to get at this data,” said Sprint’s Von McConnell. But it’s not just advertisers that are hungry for Big Data: retail outlets, corporate brands, loyalty clubs, insurance companies, auto manufacturers, and more are clamoring to compete and differentiate with better customer insights and experiences. They’re all looking into their crystal ball and, more importantly, investing in the technology that holds the promise of divining and influencing customer behavior.

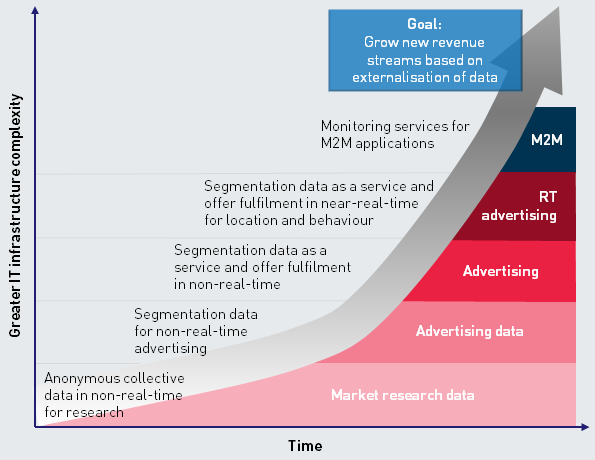

Who better to provide this data than CSPs? People around the world spend more time on their mobile devices than any other tool in the history of mankind. “CSPs’ access to mobile users in particular and their data provide a compelling proposition for advertisers looking to improve their returns,” wrote Justin van der Lande, senior analyst at Analysys Mason, on the firm’s website in April. There are many opportunities in this area for CSPs to grow revenue with Big Data, as illustrated in figure 2.

Source: Analysys Mason, 2013