Mobile Mash-up 2013: The Changing Competitive Landscape in the US

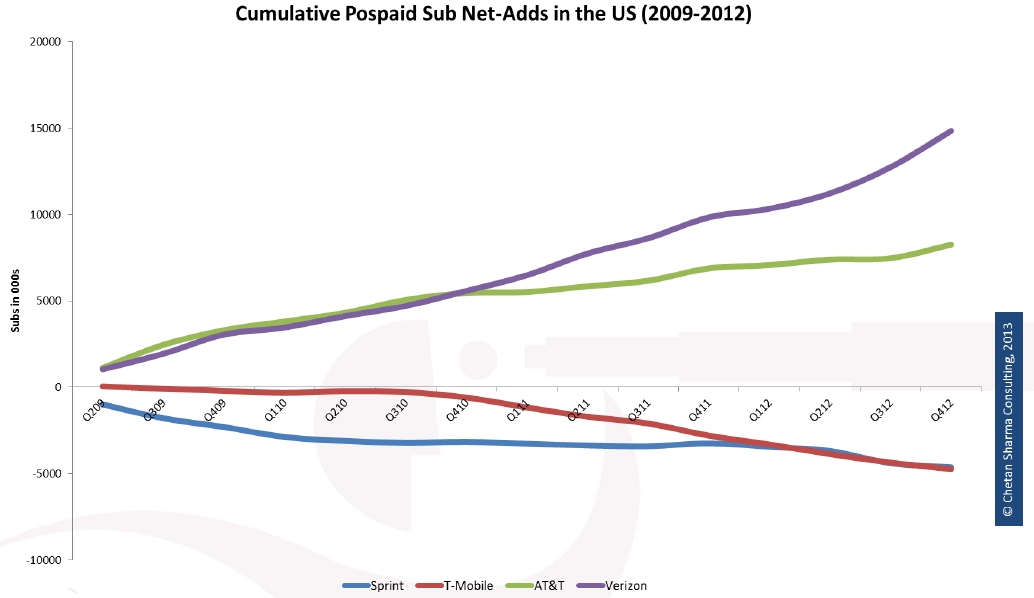

Even though most wireless service providers in the US offer 4G coverage and the sleek Apple iPhone 5 and Samsung Galaxy S III, Verizon and AT&T continue to pull ahead of their competitors, as illustrated in figure 2.

T-Mobile and MetroPCS

After the spectacular flameout of AT&T and T-Mobile’s near-merger in the final days of 2011, many industry pundits were surprised when the smaller of the two CSPs announced its plan to acquire MetroPCS in October 2012, especially since parent company Deutsche Telekom appeared ready to withdraw from the US market just months earlier. However, this was a fight T-Mobile’s owner was prepared to win—not only could it not afford to lose more time and money on another failed opportunity, but cultivating a better position for itself in the US market played into the German telco’s global growth strategy. Luckily for Deutsche Telekom, the stars were properly aligned this time around: the MetroPCS deal quickly won unanimous regulatory approval.

Winning over the two companies’ shareholders was a tad trickier. Those on the MetroPCS side, knowing how valuable the acquisition was for T-Mobile and Deutsche Telekom, threatened to vote down the deal. Their bluff worked: in the eleventh hour Deutsche Telekom made a “best and final offer” that was sweet enough to get the nod from MetroPCS’s shareholders, and on May 1 the deal was complete. Some supposed “insiders” hinted that the new two-for-one CSP would dub itself “T-Metro,” but T-Mobile indicated that both brands would continue to operate under their own names despite the fact that their combined stock will trade as T-Mobile US (TMUS).

The acquisition of MetroPCS will expand the size of T-Mobile by about nine million subscribers, or 2 percent of its existing US base, but this deal is really all about spectrum—specifically, LTE-ready spectrum. The immediate result of combining the two CSPs’ networks is a 40 percent increase in LTE spectrum; MetroPCS customers will transition from the provider’s CDMA network to T-Mobile’s GSM network, after which the CDMA assets will be decommissioned and repurposed for 4G LTE, unlocking 20x20 MHz blocks of high-speed airspace.

Inherent to LTE are cost savings and service advantages, and once the two networks converge and the support systems are flattened, TMUS will have a single network with enough speed, reach and infrastructure management systems to make it competitive with the networks of Verizon, AT&T and Sprint. CSPs with larger networks also enjoy better bargaining leverage with vendors.