By: Phil Griston

We’ve all seen the predictions that global IP traffic growth will continue to accelerate as cloud computing demand, mobile devices, video streaming, and machine-to-machine communications keep pumping packets onto the network. Leading the growth is mobile data traffic, accelerating at least three times faster than fixed IP traffic as consumers and businesses expect full connectivity wherever they may be.

The Rise of LTE

To cope with this explosive growth, and react to the fact that ARPU is not growing nearly so rapidly, mobile operators are looking to LTE. This technology makes it possible to extract more capacity out of the wireless channel; providing down-link peak rates of 300 Mbit/s, uplink peak rates of 75 Mbit/s and QoS provisions for round trip times of less than 10ms. LTE also offers the ability to manage fast-moving mobiles, and support for multi-cast and broadcast streams.

In an LTE world, the cost of a delivered bit of data is lower thanks to its simplified architecture (basically a flat RAN with IP core) and increased spectral efficiency. Nevertheless, there is a cost to achieving this. New equipment is required at the tower and the resulting increased traffic still has to be delivered. Juniper Research recently calculated that mobile network operators will have to spend $840 billion globally on optimizing backhaul assets and adding capacity over the next five years. Many operators simply can’t afford this and will look to offload traffic to other network operators with more efficient network models.

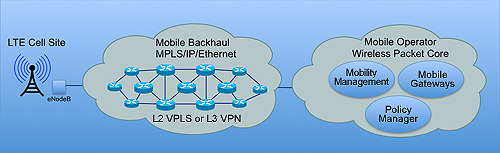

Figure 1: All packet networks from RAN to the Wireless Core lowers transport costs

The Challenge of the Backhaul Market

This increased demand has created a market. Competitive wholesalers, cable operators and wireless backhaul specialists are all joining the traditional carriers in competing for the backhaul business.

While each type of competitor has different advantages, all must deal with certain key requirements.

- Rising volumes of traffic mean that legacy TDM connections won’t scale at an economic rate. Since LTE is optimized for packet networks, Carrier Ethernet is emerging as the cost-effective way to handle the growing demand over, wherever possible, fiber connections to the tower. Most players in the backhaul market are aggressively laying fiber to as many towers as possible or in the case of players like Level 3, teaming with the tower providers to build new towers close to their existing fiber network.

- LTE demands low latency connections and mobile customers demand high service levels. Dropped calls and constantly buffering video playback will result in lost business. Backhaul SLAs need to be stringent.

- Infrastructure is expensive. It has to be used efficiently and capacity upgrades have to be done on time. Too early means money is spent unnecessarily, too late and service levels will be missed as traffic demand outstrips available capacity. Backhaul providers are doing everything they can to win multiple customers from the same tower, thus allowing them to spread the cost of the investment. Carrier Ethernet makes provisioning capacity quicker and cheaper but successful players are still looking to ensure that the return on every dollar spent is maximized.