Coopetition: The New World Order of Communications Services

VoIP offerings from providers like Comcast and Vonage initially represented serious threats to telcos' revenue streams for fixed-line telephone service. At Acme Packet University in March of this year, Diane Myers, directing analyst for VoIP and IMS at Infonetics Research, reported that Comcast's VoIP revenue reached $3.5 billion. But, the demand for traditional residential VoIP may be tapering off. Comcast added 732,000 digital voice subscribers in 2011 to reach 9,342,00 (a 6-percent gain), and Vonage ended 2011 with 2,374,887 subs, down about 30,000 from 2010. And, even though more and more households are eschewing wireline voice entirely, the fact that wireless is overshadowing and the comparatively low ARPU for voice vs. video, it appears Telco TV created a competitive edge as the battle between them wages on.

However, while these old rivals duked it out, another threat grew in the shadows. The recent advent of mobile VoIP and OTT mobile VoIP applications (apps) are just starting to take its toll, as well as the emergence of Skype for Windows phones, XBOX, and enterprise Office environments around the world. The notion of free wireless VoIP and video coupled with unified communications (UC) is daunting to say the least. Particularly at a time when Telcos are investing heavily in network capacity to support the bandwidth that apps like Skype consume.

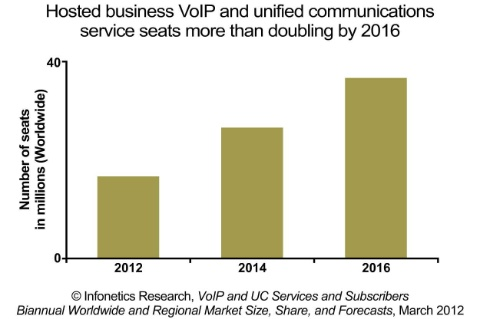

But today, VoIP isn't just a game for the cable and OTT players. Telcos have crafted and deployed compelling VoIP and UC solutions for small, medium, and large corporate customers, municipalities, and governments. In fact, according to the most recent InStat research, globally, NTT is the leading VoIP service provider, followed by Comcast and then France Telecom. The market for VoIP and UC will continue to grow, specifically in the business segment, as you can see in Fig. 2.

Myers explained her latest projections:

"The revenue that service providers derive from their residential and SOHO VoIP subscribers still eclipses what they get from businesses, but the business segment is growing about twice as fast, due in large part to the surging popularity of SIP trunking and hosted VoIP and UC services. Adoption of VoIP services across both the residential and business segments continues to grow, and we expect strong global growth in VoIP service revenue over at least the next five years."

In the wireless market, telcos continue to function as the only game in town, as network build-outs have proved too costly and time consuming for the daring of MSOs such as Cox Communications and ISPs like Sonic.net who've attempted to launch a wireless offering. But this won't last forever. Wholesale models, the move to all-IP-based networks (thus lowering the technological barrier to entry), and cooperative agreements, such as the recent partnership between Verizon and Comcast, will eventually dilute--if not dissolve--the telco monopoly on wireless voice as a service.