What's Next for Mobile?

By: Nancee Ruzicka

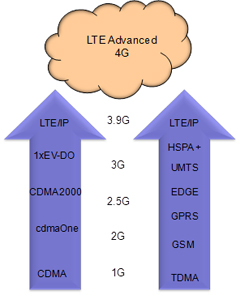

In a matter of only two decades, mobile network operators have evolved from delivering low bandwidth voice access services to broadband IP data services that are available over-the-air to anyone with the right device. Ads are everywhere for 4G/LTE and broadband mobile data, but GSMA reports that nearly 75 percent of global wireless connections in 2012 were made using 2G networks. While that number remains steady over the next five years, growth continues in the number of 3G connections, estimated to top out at roughly 4.2 billion in 2017 before leveling off. As subscribers trade up to new technologies and smart phones, the number of 2G and 3G connections level off but don’t really decline. While 4G/LTE penetration is increasing, much of the world continues to build 2G and 3G networks.

When it comes to mobile networks, it seems that every version of every access technology is still up and running somewhere and with good reason. Communication service providers (CSPs) spent a lot of money to purchase exclusive rights to precious radio spectrum and they aren’t about to let that asset gather dust. But, as technology advances and improves, what choices are available to service providers?

Living the LTE Dream

LTE is an IP data network. It is different than the GSM and CDMA wireless access technologies currently in use, but is specified to be backward compatible with both, as well as WiFi and WiMax. LTE, as it is currently being deployed, is not technically 4G, although the advertisers would have us believe otherwise. Eventually a version of LTE will deliver 4G services (100Mbs capacity), but existing implementations will not deliver that for several years. In fact, a lot of 4G offerings are not LTE but existing 3G networks that have been tweaked to provide higher bandwidths.

The progression of wireless access technology has brought us to LTE. This next evolution of wireless access technology takes the mobile network one step closer to being all-IP; however, much work and investment remains before that goal can be realized. In the meantime, CSPs will be required to operate parallel networks and OSS/BSS environments to ensure that mobile IP data bandwidth and rates can be delivered while maintaining existing voice, messaging, and data service quality.

Devices designed to work with 2G and 3G networks (e.g. all of them) will require changes to operate with LTE. Handoffs from LTE to existing 2/3G networks are challenging and service quality is far from certain. On the operations side, CSPs are required to orchestrate multiple OSS/BSS solutions and data while maintaining transparency for their customers.

In mature markets where operators spend billions to deploy the latest and greatest wireless access technology, they still own spectrum and infrastructure in other bands and therein lies the challenge.

Reduce, Reuse, Recycle

Even as the increase in 2G and 3G connections in emerging markets begins to level off, operators will still use the spectrum. In mature markets, connections to lower speed, lower capacity networks are being used for everything from vending machines to shipping containers, education and emergency services. Utilities, oil and gas exploration companies, and others that collect telemetry from meters distributed across a wide region, can make use of 2G and 3G access networks rather than relying on unlicensed spectrum.

Many of the M2M devices that make up the Internet of Things (IoT) will connect to 2G or 3G networks. For a lot of applications the sensors and telemetry devices being deployed don’t require much bandwidth and can be captured using 2G networks. Likewise, IoT collection points in warehouses, shipyards, or airports can capture data locally using 2G and send it on to the cloud or central applications using 3G or 4G. There are certainly challenges in operating multiple parallel networks, but these are sunk costs and operators should get some return on those investments. If the plan is to retire those networks, then the sooner the better so that hardware and expertise can be resold in emerging markets.