Then there are the point-solutions, the lone ISVs. (Cue: Tumbleweed).This represents a matrix of companies that are attempting to take their shot at the big guys. But, in perspective, it’s a bit more like David and Goliath than a showdown at the O.K. Corral. Arguably, Oracle’s marketing budget is possibly more than some of these ISVs annual revenues.Amdocs has annual revenues of $3 billion dollars and Oracle has revenues around $27 billion dollars, while some of the best ISVs tend to be between the $30-$100 million dollar marks. From a competitive standpoint, this means while some companies can afford to swoop in on a private jet to wine-and-dine C-level CSP executives, ISVs are beating the streets with a skeleton crew. Hardly seems fair, but, the real impact of this is that truly innovative, best-of-breed solutions have a slim-to-none chance at ever gracing the desk of OSS/BSS buyers which means top ISVs and CSPs are both missing out. So what’s one to do?

Enter Microsoft

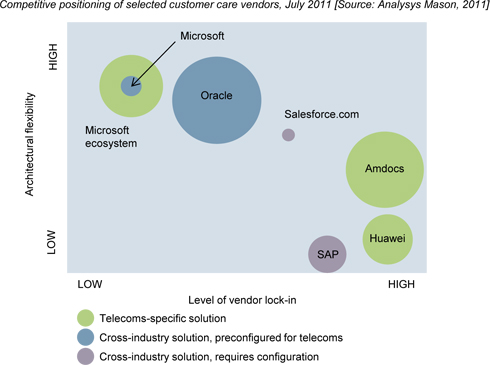

Microsoft recently announced a “mashable partner ecosystem” that enables ISVs with OSS/BSS products to build vertical solutions on top of the horizontal Microsoft platforms like Microsoft Dynamics CRM. ISVs and System Integrators such as: Alcatel-Lucent’s Genesys Telecommunications Laboratories (NYSE: ALU); Cap Gemini (Paris: CAP.PA); Convergys (NYSE: CVG); Ericsson (NASDAQ: ERIC); MetraTech; Redknee (TSX: RKN); Tech Mahindra (NASDAQ: NSE); Tribold; have joined forces with Microsoft to offer CSPs a sort of best-of-breed-framework hybrid model (Fig. 2). On the surface, this might not sound all that revolutionary, but it is and here’s why: Microsoft is putting their money, relationships, reputation, and brand behind their partners and has already begun to pay dividends.

Microsoft is already investing $10 billion annually in innovation and R&D and at least some part of that is dedicated to helping partners build upon Microsoft products. But, in addition to technical support, Microsoft is providing its partners with the visibility and the relationships they need to break into CSPs accounts and sell their solutions to Microsoft customers. With over 30,000 Microsoft Dynamics CRM customers worldwide, and a significant and growing contingency of services providers like Virgin Mobile (India), TDC (Denmark), Oi (Brazil), Vodafone (Italy, Iceland), KDDI (Japan), and Telefonica (Spain) – just to name few – it’s an enormous advantage. This is primarily because both Microsoft and BSS ISVs are targeting the same buyer within CSP organizations and where the ISV doesn’t have a relationship, Microsoft is brokering one for them.