Thompson went on to point out that the device replacement cycle (as illustrated earlier in Fig. 2) is much longer in M2M—sometimes ten years or longer. Customers are wary of deploying thousands of devices that might not be supported in the long-term. “For devices expected to operate in the field for the long term, 3G or even 4G is the clear choice today,” added Thompson.

Recent research by Forrester supports this perspective. In a Nov. 2011 whitepaper, analyst Michele Pelino wrote, “Many of today's M2M apps are adequately supported by lower speed 2G networks. However, upgraded 3G and 4G networks provide new options to support M2M services requiring high-quality video content, which is particularly relevant to healthcare and video surveillance applications.”

Market Overview

Currently, AT&T, Telenor, and Verizon have the most mature businesses in the M2M space, according to an exhaustive market study performed by Machina Research. This is based largely on the CSPs’ currently installed M2M base. Â Following close behind in terms of installations are Vodafone, China Mobile, and Telefonica.

However, success is not just about who has the largest installed base of M2M connections. As the dynamics rapidly change in the coming years, other factors will come into play. Machina Research published a M2M Benchmarking study in January that looked at M2M opportunities for each carrier based on six “Ps”: Pedigree, Platform, Place, Partnerships, Process, and People. The results were surprising.

Study author Matt Hatton said, "Machina Research rates Vodafone as the CSP with the best potential to exploit the massive opportunities presented by machine-to-machine. In particular its global scale gives it a substantial competitive differentiator. While I wouldn't say they were streets ahead of the competition, Vodafone was our clear winner. However, the race for second spot was very hotly contested between AT&T, Deutsche Telekom, Orange, Telefonica, Telenor and Verizon, with little to choose between them."

Opportunities

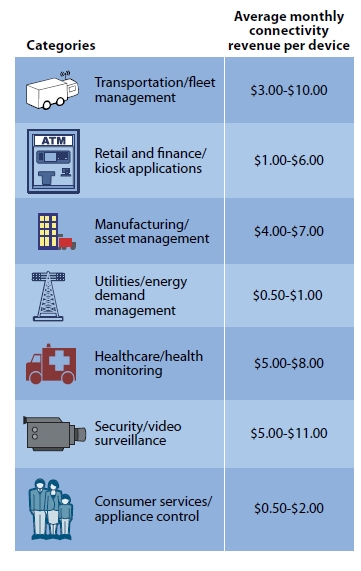

If the telecommunications industry has learned anything from the past, it should know that building a pipe is not enough. M2M connectivity revenues alone will not be enough to offset declines in traditional revenue. As you can see in Figure 3, connectivity revenue alone does not represent the pot at the end of the rainbow.