article page |

1 |

2 |

3 |

4 |

5

the way for a new breed of IT services based on cloud computing and software as a service.

Meanwhile, CLECs' wholesale operations are getting an injection of new life thanks to trends in wireless backhaul—the transport of traffic from cellular towers to network hubs and points of presence2. Mobile applications such as Internet browsing, photo- and video-sharing, social networking, and gaming are driving deployment of higher capacity fourth-generation wireless technologies such as WiMAX and LTE and with them, greater bandwidth in wireless carriers' backhaul networks. Although cell site backhaul is still largely dependent on copper-fed TDM circuits (T-1s) provided by incumbent telcos, other physical media—fiber lines and fixed wireless (microwave)—and next-generation technologies, namely metro Ethernet, represent alternatives that CLECs can use to compete head-to-head with incumbents.

Despite these growth opportunities, CLECs' ability to scale through mergers and acquisitions has been shackled by weakness in the economy. As capital markets chilled in 2008 and 2009, M&A activity in the CLEC sector grew quiet, especially relative to the mid-decade megamergers conducted by the likes of AT&T, Verizon, Level 3, and PAETEC.

|

|

Fast Ethernet (100 Mbps) and Gigabit Ethernet offerings have allowed CLECs to compete for large enterprise and government/education customers. |

|

Where CLECs acted in 2008 and 2009, they generally added piece parts. By and large, players in the sector and the broader industry are keeping their powder dry for when revenues are stronger and financing loosens up, with a resumption in deal-making by the end of 2010 likely.

Looking Ahead

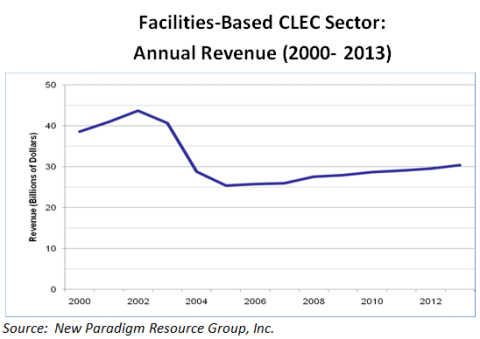

Facilities-based CLECs have made a solid comeback from the sector's decimation in 2000-2004. The carriers that remain—true survivors—are typically bigger, more sophisticated, and keener competitors than the upstarts that characterized the go-go years. In the short-term, growth for individual CLECs is at risk for as long as the economy remains weak. As the economy rebounds and credit markets thaw, further consolidation is likely, and the sector should see modest revenue growth —a low single-digit percentage, in aggregate—in the first few years of the new decade.

|

|

|

|

2 See New Paradigm Resources Group, Inc.'s "Wireless Backhaul Market Study - 2009;" http://reports.nprg.com.

article page |

1 |

2 |

3 |

4 |

5

|

|

|

|